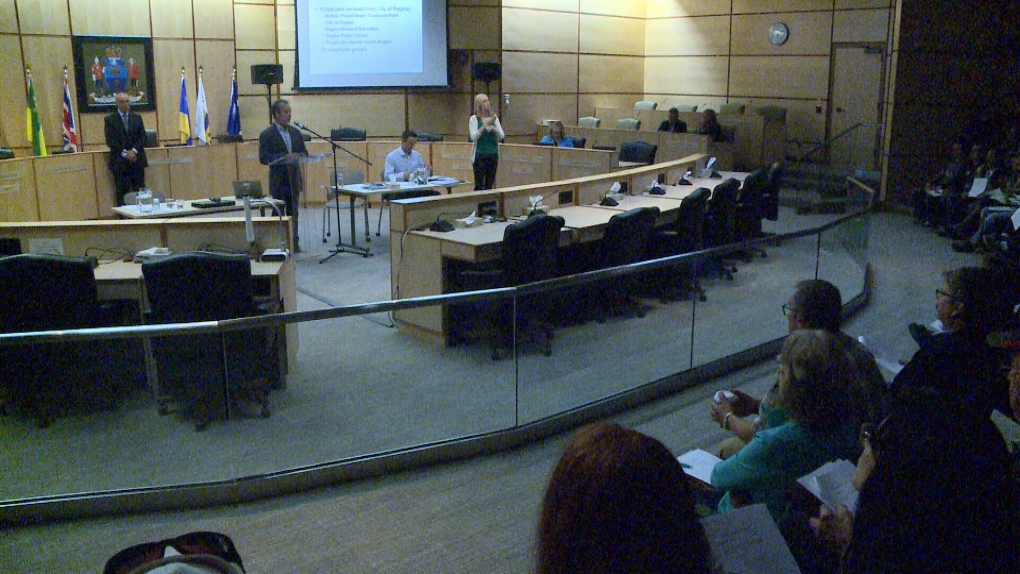

The City of Regina outlined proposed changes to the city’s troubled pension plan at the first of five information sessions.

Current employees and retirees packed the city council chamber for Friday’s presentation.

The city recently put forward a proposal which it says is similar to a 2013 letter of intent between the city and employee groups, with some changes.

Curtis Smith, the city’s manager of policy and risk management, says the new proposal includes a soft cap on contribution rates, a new governance structure and stricter funding policies.

Employers would pay 70 per cent of the deficit, while employees would pay 30 per cent. That’s a change from the letter of intent, which proposed that employees pay 40 per cent of the deficit.

Employees who are 55 or older would be eligible for retirement if their age plus years of service equal at least 85. That’s up from 80 in the letter of intent.

Cost-of-living adjustments are currently guaranteed, but they would be conditional under the new proposal.

The years of earning calculation would increase from the average of the highest consecutive three years to that of the highest consecutive five years.

In addition, overtime pay would no longer be included as pensionable earnings, effective Jan. 1 of next year.

Contribution rates would be fixed at an estimated blended employee rate of 10.5 per cent, while the employer rate would be 11.6 per cent. Those rates are subject to a potential one-time increase of 0.5 per cent for each side under certain circumstances.

Smith said there would be no changes to benefits for retirees or benefits earned to date.

In terms of governance, a 15th voting member would be added to break ties so decisions are made on a timely basis.

Saskatchewan’s superintendent of pensions has said the plan, which is over $290 million in deficit, could be cancelled unless it is fixed by the end of the year.

Established in 1958, the Regina civic employees’ pension plan currently has 6,700 members, including nearly 3,000 retirees.