Fitness Tax considered 'short sighted' within gym industry

The Saskatchewan fitness industry isn’t looking to carry the PST load for the provincial government.

An advocate group recently came out with a petition, which has been signed by around 5,000 people. It calls on the government to drop its 6 per cent hike, which is set to take effect in October.

For those at the local level, it isn’t appreciated.

“People are very frustrated because prices [are rising] across the board,” said Edward de Vries, owner of Yorkton’s Anytime Fitness. “Increasing food costs. Fuel costs are going up. Housing costs are going up. It seems like it's just another thing that the government is burdening the citizens with.”

De Vries was quick to point out the various positives the gym industry provides for the public.

“We are part of healthcare. We help keep a lot of individuals out of the primary care. We can help shorten the lines to all the emergency care services because of the things that we offer,” he said.

“And I think adding additional cost to the citizens too, it is going to make them less healthy.

The rise in PST is also getting the attention across the nation. The Fitness Industry Council of Canada offered the aforementioned petition to those online, using change.org. It had 4,955 signatures as of Monday afternoon.

Its president, Sarah Hodson told CTV News the decision was “short sighted.”

“In fact, (the) fitness tax … is kind of similar to what Sesame Street taught us as children — one of these things just doesn't belong,” she explained. “Fitness does not belong in an entertainment category. It is fundamental to the future of our healthcare system and to the financial burden that is coming for our healthcare system.”

Hodson explained that the provincial government’s move is in contrast with what the rest of the country is doing.

“In many other provinces — and federally — we are moving towards financial incentives for people to participate in physical activity,” said Hodson.

“So this is completely upside down thinking.”

The province expanded the PST to cover a backlog of surgeries in Saskatchewan. Shortly after it was announced, the federal government said it would commit around $2 billion for the same reason. Saskatchewan would be given roughly around $62 million from the fund.

The increase will amount to roughly $5 to $6 per month for the average gym member. Hodson said people would benefit from the opposite of what the tax was created for.

“Gym goers will likely pay this extra 6 per cent because they are already being active. They've already built that healthy habit into their life,” she said.

“But when we're looking at people and when the mental health in this country is the lowest that it has ever been, and we are trying to encourage people to start healthy behaviors, yet we put a tax on that … This is not the time or the place to do that.”

In a statement, the Ministry of Finance said the government is making the change “in order to improve revenue stability.”

“The existing application of PST is being broadened to match the federal GST for admissions, entertainment and recreation. A more stable revenue base helps ensure priority services and programs are sustainable into the future,” the statement continued.

The PST will be put into effect October 1, 2022.

CTVNews.ca Top Stories

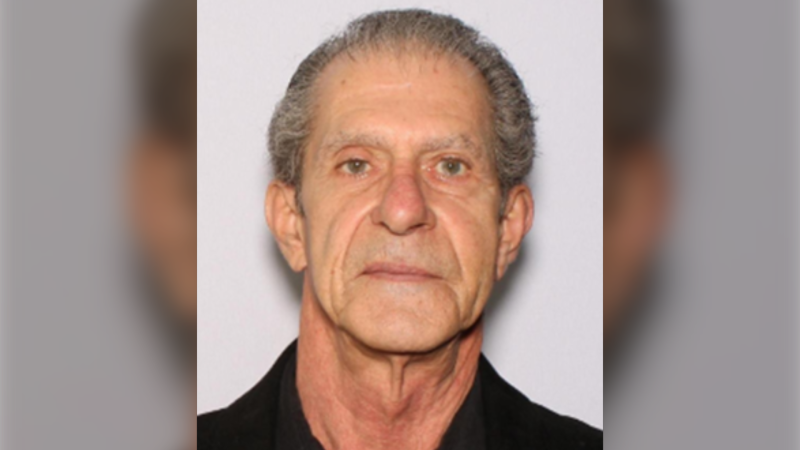

Widow looking for answers after Quebec man dies in Texas Ironman competition

The widow of a Quebec man who died competing in an Ironman competition is looking for answers.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

World seeing near breakdown of international law amid wars in Gaza and Ukraine, Amnesty says

The world is seeing a near breakdown of international law amid flagrant rule-breaking in Gaza and Ukraine, multiplying armed conflicts, the rise of authoritarianism and huge rights violations in Sudan, Ethiopia and Myanmar, Amnesty International warned Wednesday as it published its annual report.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

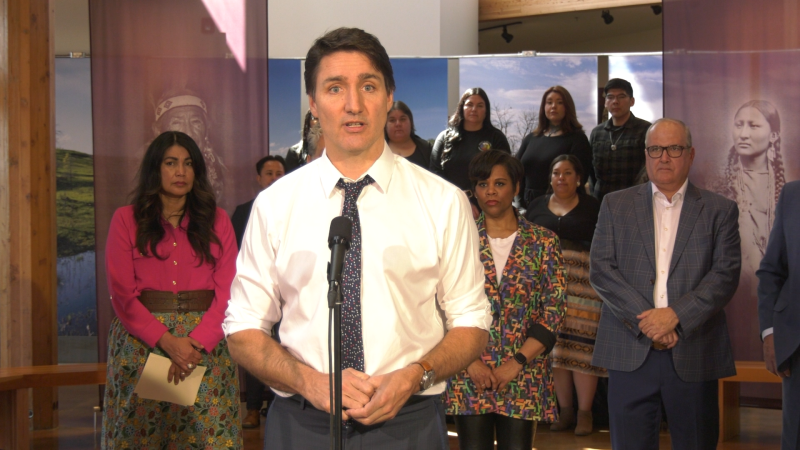

Amid concerns over 'collateral damage' Trudeau, Freeland defend capital gains tax change

Facing pushback from physicians and businesspeople over the coming increase to the capital gains inclusion rate, Prime Minister Justin Trudeau and his deputy Chrystia Freeland are standing by their plan to target Canada's highest earners.

U.S. Senate passes bill forcing TikTok's parent company to sell or face ban, sends to Biden for signature

The Senate passed legislation Tuesday that would force TikTok's China-based parent company to sell the social media platform under the threat of a ban, a contentious move by U.S. lawmakers that's expected to face legal challenges.

Wildfire southwest of Peace River spurs evacuation order

People living near a wildfire burning about 15 kilometres southwest of Peace River are being told to evacuate their homes.

U.S. Senate overwhelmingly passes aid for Ukraine, Israel and Taiwan with big bipartisan vote

The U.S. Senate has passed US$95 billion in war aid to Ukraine, Israel and Taiwan, sending the legislation to President Joe Biden after months of delays and contentious debate over how involved the United States should be in foreign wars.

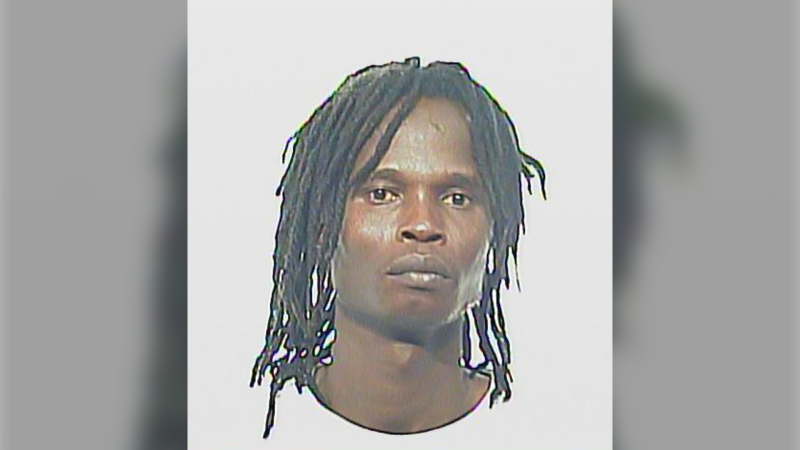

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.