Here are 5 strange insurance fraud schemes attempted in Sask.

From rolling back an odometer 150,000 kilometres to intentionally causing a collision, Saskatchewan Government Insurance (SGI) is highlighting its top five insurance fraud cases of 2022.

SGI’s Special Investigation Unit (SIU) busted hundreds of fraudulent claims in 2022 resulting in $5.8 million in savings, the agency said in a news release.

'HEIST HOAX'

SGI said a customer reported their vehicle missing and claimed it had been parked in front of their house with a spare key locked inside.

One hour after the vehicle was reported missing, police found it a short walk from the person’s house on the front lawn of someone else’s property after it had collided into a nearby parked vehicle and tree.

The vehicle’s owner filed a theft and collision claim while another person filed a claim for the parked vehicle and property damage.

SGI said security camera footage showed the vehicle in question travelled at a high rate of speed, lost control and collided with a parked vehicle and then a tree.

The driver then walked away from the vehicle, locking it with a key fob.

The person confessed to the collision and said they should not have been driving at the time.

They owed $50,000 in vehicle and property damage.

'ROLLBACK RIP-OFF'

Someone submitted a claim that said they drove their truck through a dip with standing water, which caused the engine to quit. It was discovered that the truck actually needed a costly engine repair or replacement.

SIU also discovered the vehicle’s odometer had been rolled back 150,000 kilometres in order to increase the value of the truck.

The claim was withdrawn after the person was confronted by SIU which saved SGI $7,000.

'TURNOFF TALES'

SGI saved $40,000 after a fraudulent claim stated that a driver and his girlfriend were in a collision with an abandoned vehicle while driving in foggy conditions after missing a turnoff.

The drivers said they panicked and instead of calling police, they walked to a nearby home.

The homeowners reported to police that the couple said they did not want police to know about the collision.

“Police visited the collision site and saw several concerning items inside the vehicle, including drug paraphernalia. Additionally, there was no evidence of fog that morning and no nearby turnoff that the driver could have missed. SIU discovered the vehicle was travelling at double the reported speed, and additional witnesses claimed Connor and his girlfriend were both very intoxicated. SIU found [the claimant’s] account of the incident was unreliable and vague,” the release said.

'DEER DUPE'

A person filed a claim that stated they hit a deer and left their vehicle at the scene of the collision before coming back to find the vehicle completely burned.

SIU spoke with a witness who saw two people removing belongings from inside the vehicle before it went up in flames a short time later.

SIU discovered the vehicle was not registered at the time of the collision and registration was then purchased less than an hour after the crash.

SIU said it believes the driver also returned to set the vehicle on fire in order to receive a cash payout.

SGI denied the claim and saved $5,000.

'SLEEPING SCAM'

Someone filed a claim stating they had fallen asleep and collided with a parked vehicle. After admitting to dealing with significant financial hardship the person revealed they had recently spoken with a bailiff about the vehicle, a high value SUV, being repossessed.

SIU confirmed the person was experiencing financial troubles and then discovered the person caused the collision intentionally to avoid having the vehicle repossessed.

SGI said it saved $63,000 after denying the claim.

“When making insurance claims, the important thing to do is always be honest about the incident,” SGI said in a release.

Potential insurance fraud cases can be reported to SGI or Saskatchewan Crime Stoppers.

CTVNews.ca Top Stories

BREAKING Iran fires at apparent Israeli attack drones near Isfahan air base and nuclear site

An apparent Israeli drone attack on Iran saw troops fire air defences at a major air base and a nuclear site early Friday morning near the central city of Isfahan, an assault coming in retaliation for Tehran's unprecedented drone-and-missile assault on the country.

NEW After hearing thousands of last words, this hospital chaplain has advice for the living

Hospital chaplain J.S. Park opens up about death, grief and hearing thousands of last words, and shares his advice for the living.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Ontario woman loses $15,000 to fake Walmart job scam

A woman who recently moved to Canada from India was searching for a job when she got caught in an online job scam and lost $15,000.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

Colin Jost names one celebrity who is great at hosting 'Saturday Night Live'

Colin Jost, who co-anchors Saturday Night Live's 'Weekend Update,' revealed who he thinks is one of the best hosts on the show.

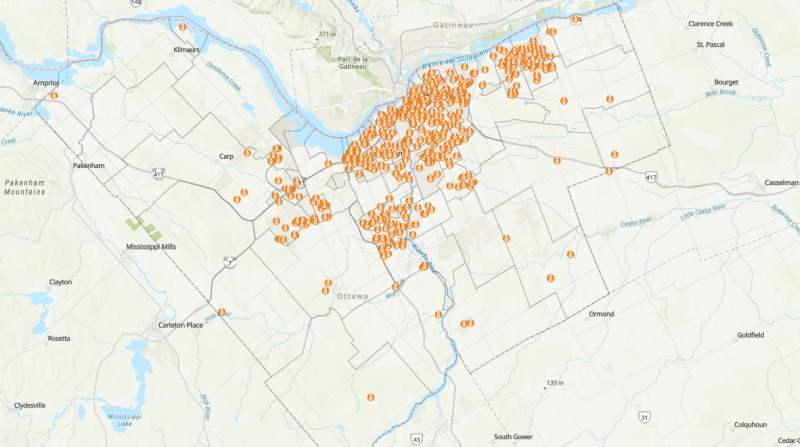

Ottawa to force banks to call carbon rebate a carbon rebate in direct deposits

Canadian banks that refuse to identify the carbon rebate by name when doing direct deposits are forcing the government to change the law to make them do it, says Environment Minister Steven Guilbeault.

DEVELOPING G7 warns of new sanctions against Iran as world reacts to apparent Israeli drone attack

Group of Seven foreign ministers warned of new sanctions against Iran on Friday for its drone and missile attack on Israel, and urged both sides to avoid an escalation of the conflict.

Some Canadian families will receive up to $620 per child today

More money will land in the pockets of some Canadian families on Friday for the latest Canada Child Benefit installment.