Here are 5 strange insurance fraud schemes attempted in Sask.

From rolling back an odometer 150,000 kilometres to intentionally causing a collision, Saskatchewan Government Insurance (SGI) is highlighting its top five insurance fraud cases of 2022.

SGI’s Special Investigation Unit (SIU) busted hundreds of fraudulent claims in 2022 resulting in $5.8 million in savings, the agency said in a news release.

'HEIST HOAX'

SGI said a customer reported their vehicle missing and claimed it had been parked in front of their house with a spare key locked inside.

One hour after the vehicle was reported missing, police found it a short walk from the person’s house on the front lawn of someone else’s property after it had collided into a nearby parked vehicle and tree.

The vehicle’s owner filed a theft and collision claim while another person filed a claim for the parked vehicle and property damage.

SGI said security camera footage showed the vehicle in question travelled at a high rate of speed, lost control and collided with a parked vehicle and then a tree.

The driver then walked away from the vehicle, locking it with a key fob.

The person confessed to the collision and said they should not have been driving at the time.

They owed $50,000 in vehicle and property damage.

'ROLLBACK RIP-OFF'

Someone submitted a claim that said they drove their truck through a dip with standing water, which caused the engine to quit. It was discovered that the truck actually needed a costly engine repair or replacement.

SIU also discovered the vehicle’s odometer had been rolled back 150,000 kilometres in order to increase the value of the truck.

The claim was withdrawn after the person was confronted by SIU which saved SGI $7,000.

'TURNOFF TALES'

SGI saved $40,000 after a fraudulent claim stated that a driver and his girlfriend were in a collision with an abandoned vehicle while driving in foggy conditions after missing a turnoff.

The drivers said they panicked and instead of calling police, they walked to a nearby home.

The homeowners reported to police that the couple said they did not want police to know about the collision.

“Police visited the collision site and saw several concerning items inside the vehicle, including drug paraphernalia. Additionally, there was no evidence of fog that morning and no nearby turnoff that the driver could have missed. SIU discovered the vehicle was travelling at double the reported speed, and additional witnesses claimed Connor and his girlfriend were both very intoxicated. SIU found [the claimant’s] account of the incident was unreliable and vague,” the release said.

'DEER DUPE'

A person filed a claim that stated they hit a deer and left their vehicle at the scene of the collision before coming back to find the vehicle completely burned.

SIU spoke with a witness who saw two people removing belongings from inside the vehicle before it went up in flames a short time later.

SIU discovered the vehicle was not registered at the time of the collision and registration was then purchased less than an hour after the crash.

SIU said it believes the driver also returned to set the vehicle on fire in order to receive a cash payout.

SGI denied the claim and saved $5,000.

'SLEEPING SCAM'

Someone filed a claim stating they had fallen asleep and collided with a parked vehicle. After admitting to dealing with significant financial hardship the person revealed they had recently spoken with a bailiff about the vehicle, a high value SUV, being repossessed.

SIU confirmed the person was experiencing financial troubles and then discovered the person caused the collision intentionally to avoid having the vehicle repossessed.

SGI said it saved $63,000 after denying the claim.

“When making insurance claims, the important thing to do is always be honest about the incident,” SGI said in a release.

Potential insurance fraud cases can be reported to SGI or Saskatchewan Crime Stoppers.

CTVNews.ca Top Stories

Senate expenses climbed to $7.2 million in 2023, up nearly 30%

Senators in Canada claimed $7.2 million in expenses in 2023, a nearly 30 per cent increase over the previous year.

Pedestrian, baby injured after stroller struck and dragged by vehicle in Squamish, B.C.

Police say a baby and a pedestrian suffered non-life-threatening injuries after a vehicle struck a baby stroller and dragged it for two blocks before stopping in Squamish, B.C.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

Demonstrators kicked out of Ontario legislature for disruption after failed keffiyeh vote

A group of demonstrators were kicked out of the legislature after a second NDP motion calling for unanimous consent to reverse a ban on the keffiyeh failed to pass.

RCMP uncovers alleged plot by 2 Montreal men to illegally sell drones, equipment to Libya

The RCMP says it has uncovered a plot by two men in Montreal to sell Chinese drones and military equipment to Libya illegally.

Government agrees to US$138.7M settlement over FBI's botching of Larry Nassar assault allegations

The U.S. Justice Department announced a US$138.7 million settlement Tuesday with more than 100 people who accused the FBI of grossly mishandling allegations of sexual assault against Larry Nassar in 2015 and 2016, a critical time gap that allowed the sports doctor to continue to prey on victims before his arrest.

BREAKING Canucks goalie Thatcher Demko won't play in Game 2

The Vancouver Canucks will be without all-star goalie Thatcher Demko when they face the Nashville Predators in Game 2 of their first-round playoff series.

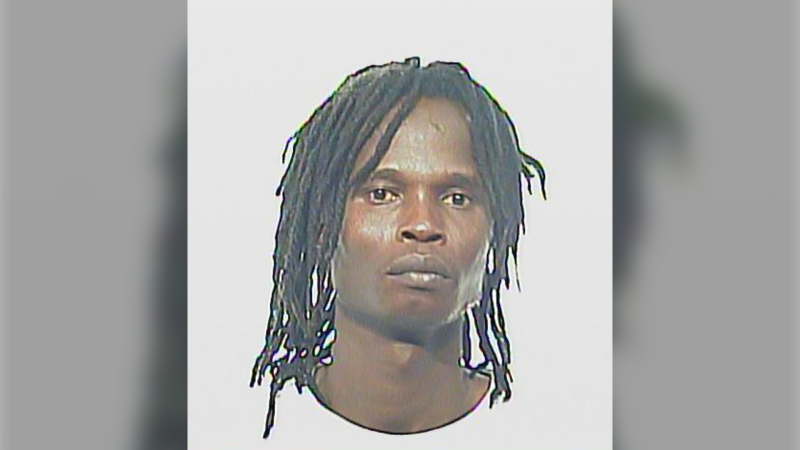

Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.