Is a massive wave of mortgage defaults coming to Sask.? One Regina broker says no

With the Bank of Canada (BoC) increasing its key rate once again this week to 4.75 per cent, many people with fixed-rate mortgages are feeling anxious about renewing.

Canada’s key interest rate is now the highest it’s been since April 2001.

Skott Enns, a mortgage broker with TMG The Mortgage Group in Regina said the latest increase, which was the first one since January, came as a surprise to many experts.

“Yeah, I think this one did take people by surprise,” Enns said. “Inflation numbers in April had increased marginally and evidentially that was all it took for the Bank of Canada to decide it was time for another increase.”

In April, inflation rose for the first time in 10 months to 4.4 per cent.

Despite the latest increase, Enns said he doesn’t believe Saskatchewan will see a plethora of mortgage defaults in the coming months.

“If you bought a home in 2018 Regina’s average house price was $325,000 and a ballpark rate back then would have been 3.54 per cent with a five per cent down payment, which meant you’d have a monthly payment of $1,629. Fast forward to today and if your mortgage is coming up for renewal, your new rate is probably going to be just a hair over five per cent, which would mean a difference of $220 [more] a month.”

Enns said one thing that could help save some people, specifically those who bought a home in the past six years, is the mortgage stress test that was implemented by the federal government in 2016, a test Ens admits he disagreed with when it was first announced.

“So all of those people that were qualified at those lower rates, even though they were two and a half per cent, they were still qualifying at about five per cent [because of the stress test]. So it’s not as though they were necessarily at the upper end of their spending limit in reality,” Enns said.

Enns also said that typically speaking, most people will be making more money than they were five years ago as they progress in their careers and gain more experience in the working world.

“I understand costs everywhere are going up, but hopefully you’re also in a better position financially as well,” he said.

One year ago, the BoC’s key interest rate was 1.5 per cent.

In July 2022, an increase of a full percentage point was announced, which was followed by three smaller increases heading into 2023 leading to today’s key rate of 4.75 per cent.

The next scheduled rate announcement is expected on July 12, 2023.

Enns said with this week’s surprising increase, the crystal ball is as foggy as ever, but said many in his industry remain hopeful some rate decreases are coming.

“Within the next say 12 months, I think that is a reasonable expectation.”

Enns admitted that while the days of one and two per cent for variable and fixed rates are more than likely gone for good, a middle ground from then to where we are now is achievable.

“We got spoiled, you know, for the better part of a decade really with those rates. If we can get back to a point where, you know, fixed rates even start with a three, I think that would be wonderful.”

-- With files from CTV News.ca.

CTVNews.ca Top Stories

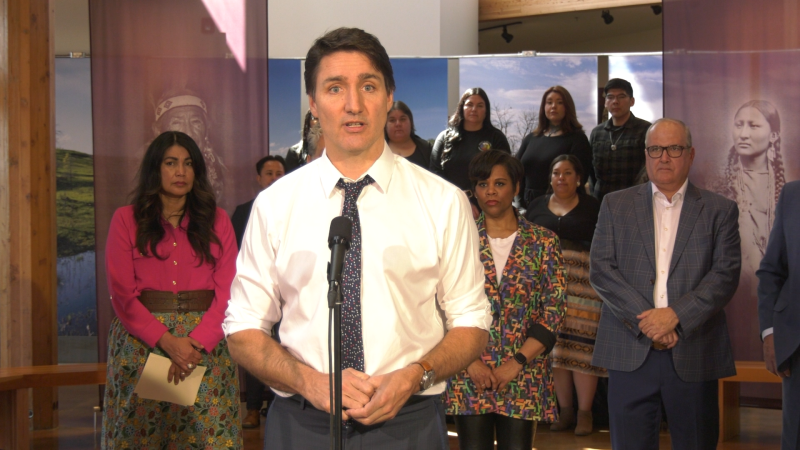

Half of Canadians have negative opinion of latest Liberal budget: poll

A new poll suggests the Liberals have not won over voters with their latest budget, though there is broad support for their plan to build millions of homes.

opinion Why you should protect your investments by naming a trusted contact person

Appointing a trusted person to help with financial obligations can give you peace of mind. In his personal finance column for CTVNews.ca, Christopher Liew outlines the key benefits of naming a confidant to take over your financial responsibilities, if the need ever arises.

'One of the single most terrifying things ever': Canadian couple among tourists on sinking sailing boat tour abroad

A Toronto couple are speaking out about their “extremely dangerous” experience on board a sinking tour boat in the Dominican Republic last week.

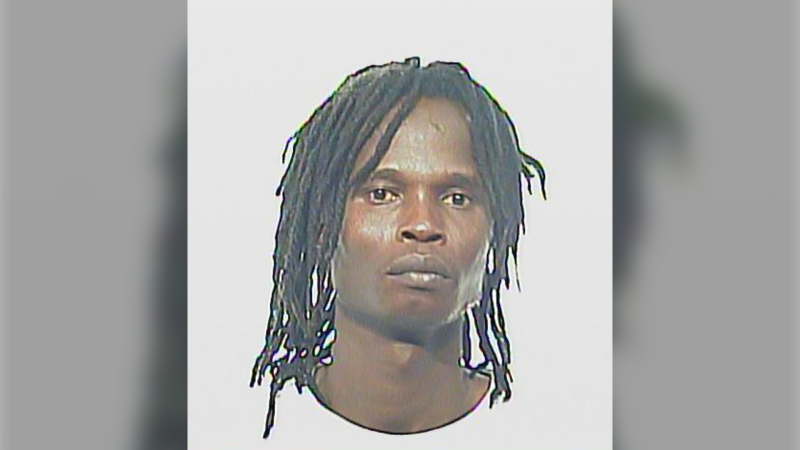

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

Ottawa injects another $36M into vaccine injury compensation fund

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

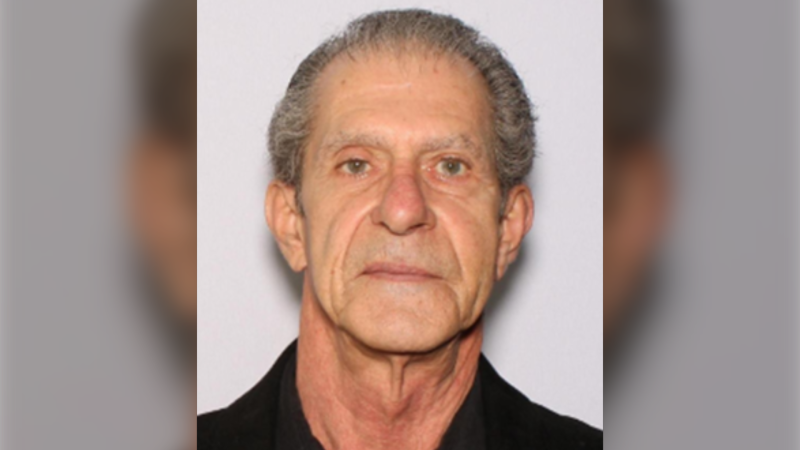

An Ontario senior called Geek Squad for help with his printer. Instead, he got scammed out of $25,000

An Ontario senior’s attempt to get technical help online led him into a spoofing scam where he lost $25,000. Now, he’s sharing his story to warn others.

Accused of burglary at stepmother's home, U.S. senator says she wanted her father's ashes: charges

A Minnesota state senator and former broadcast meteorologist told police that she broke into her stepmother's home because her stepmother refused to give her items of sentimental value from her late father, including his ashes, according to burglary charges filed Tuesday.

Twins from Toronto were Canada's top two female finishers at this year's Boston Marathon

When identical twin sisters Kim and Michelle Krezonoski were invited to compete against some of the world’s most elite female runners at last week’s Boston Marathon, they were in disbelief.