Is a massive wave of mortgage defaults coming to Sask.? One Regina broker says no

With the Bank of Canada (BoC) increasing its key rate once again this week to 4.75 per cent, many people with fixed-rate mortgages are feeling anxious about renewing.

Canada’s key interest rate is now the highest it’s been since April 2001.

Skott Enns, a mortgage broker with TMG The Mortgage Group in Regina said the latest increase, which was the first one since January, came as a surprise to many experts.

“Yeah, I think this one did take people by surprise,” Enns said. “Inflation numbers in April had increased marginally and evidentially that was all it took for the Bank of Canada to decide it was time for another increase.”

In April, inflation rose for the first time in 10 months to 4.4 per cent.

Despite the latest increase, Enns said he doesn’t believe Saskatchewan will see a plethora of mortgage defaults in the coming months.

“If you bought a home in 2018 Regina’s average house price was $325,000 and a ballpark rate back then would have been 3.54 per cent with a five per cent down payment, which meant you’d have a monthly payment of $1,629. Fast forward to today and if your mortgage is coming up for renewal, your new rate is probably going to be just a hair over five per cent, which would mean a difference of $220 [more] a month.”

Enns said one thing that could help save some people, specifically those who bought a home in the past six years, is the mortgage stress test that was implemented by the federal government in 2016, a test Ens admits he disagreed with when it was first announced.

“So all of those people that were qualified at those lower rates, even though they were two and a half per cent, they were still qualifying at about five per cent [because of the stress test]. So it’s not as though they were necessarily at the upper end of their spending limit in reality,” Enns said.

Enns also said that typically speaking, most people will be making more money than they were five years ago as they progress in their careers and gain more experience in the working world.

“I understand costs everywhere are going up, but hopefully you’re also in a better position financially as well,” he said.

One year ago, the BoC’s key interest rate was 1.5 per cent.

In July 2022, an increase of a full percentage point was announced, which was followed by three smaller increases heading into 2023 leading to today’s key rate of 4.75 per cent.

The next scheduled rate announcement is expected on July 12, 2023.

Enns said with this week’s surprising increase, the crystal ball is as foggy as ever, but said many in his industry remain hopeful some rate decreases are coming.

“Within the next say 12 months, I think that is a reasonable expectation.”

Enns admitted that while the days of one and two per cent for variable and fixed rates are more than likely gone for good, a middle ground from then to where we are now is achievable.

“We got spoiled, you know, for the better part of a decade really with those rates. If we can get back to a point where, you know, fixed rates even start with a three, I think that would be wonderful.”

-- With files from CTV News.ca.

CTVNews.ca Top Stories

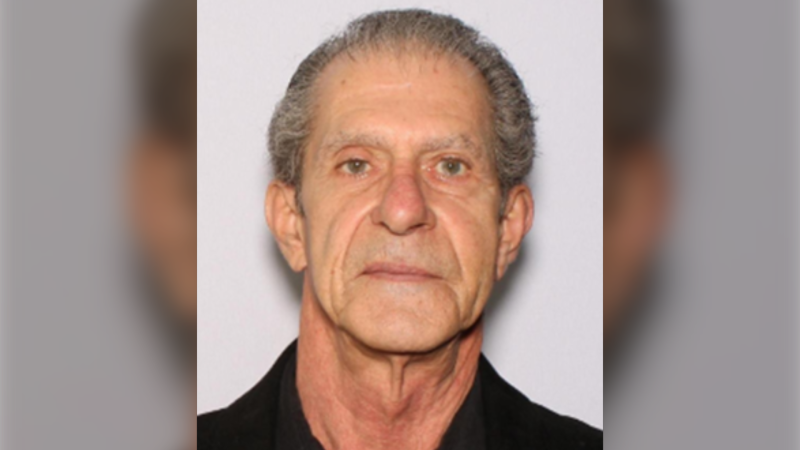

Widow looking for answers after Quebec man dies in Texas Ironman competition

The widow of a Quebec man who died competing in an Ironman competition is looking for answers.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

World seeing near breakdown of international law amid wars in Gaza and Ukraine, Amnesty says

The world is seeing a near breakdown of international law amid flagrant rule-breaking in Gaza and Ukraine, multiplying armed conflicts, the rise of authoritarianism and huge rights violations in Sudan, Ethiopia and Myanmar, Amnesty International warned Wednesday as it published its annual report.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

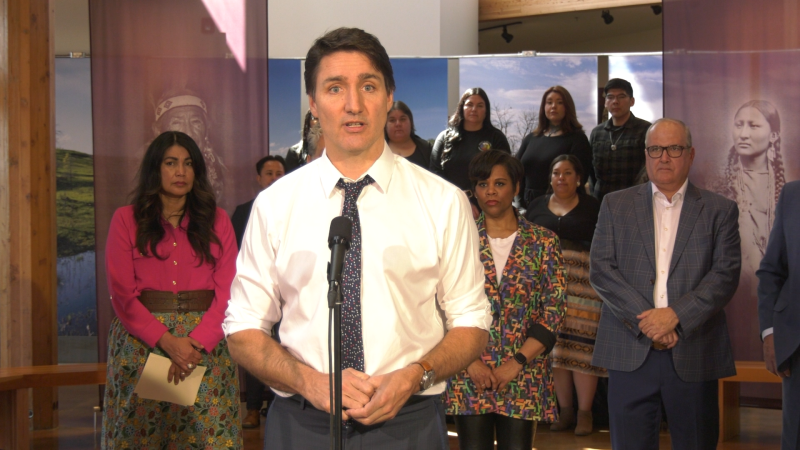

Amid concerns over 'collateral damage' Trudeau, Freeland defend capital gains tax change

Facing pushback from physicians and businesspeople over the coming increase to the capital gains inclusion rate, Prime Minister Justin Trudeau and his deputy Chrystia Freeland are standing by their plan to target Canada's highest earners.

U.S. Senate passes bill forcing TikTok's parent company to sell or face ban, sends to Biden for signature

The Senate passed legislation Tuesday that would force TikTok's China-based parent company to sell the social media platform under the threat of a ban, a contentious move by U.S. lawmakers that's expected to face legal challenges.

Wildfire southwest of Peace River spurs evacuation order

People living near a wildfire burning about 15 kilometres southwest of Peace River are being told to evacuate their homes.

U.S. Senate overwhelmingly passes aid for Ukraine, Israel and Taiwan with big bipartisan vote

The U.S. Senate has passed US$95 billion in war aid to Ukraine, Israel and Taiwan, sending the legislation to President Joe Biden after months of delays and contentious debate over how involved the United States should be in foreign wars.

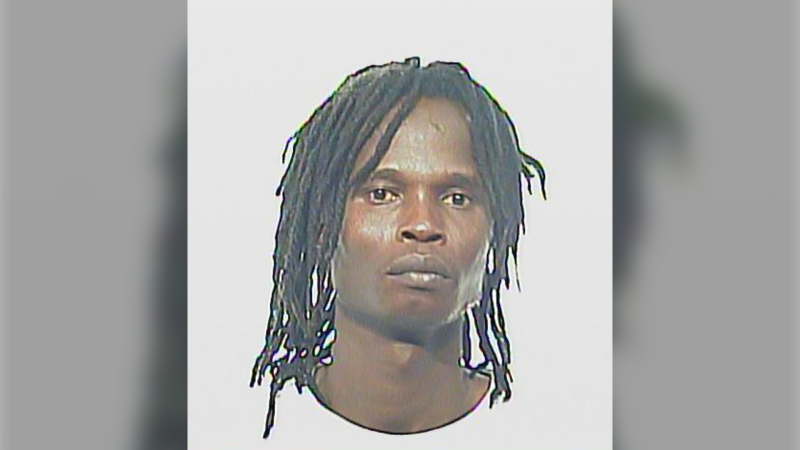

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.