Rising revenue helps cut deficit as Sask. sets sights on pandemic recovery in 2022 budget

A significant revenue jump has given Saskatchewan a lowered deficit and encouraged another year of record spending on health in the province’s 2022-23 budget.

The Government of Saskatchewan is forecasting a $463 million deficit for the fiscal year, which is a $2.1 billion improvement from last year.

"Saskatchewan is back on track," Saskatchewan Finance Minister Donna Harpauer said. "We are seeing strong economic growth and job creation as we come out of the pandemic and as a result, the provincial's financial outlook has improved significantly.”

The province is projecting $17.2 billion in revenue over the next year, rising by $2.7 billion from last year’s budget. The growth is largely driven by non-renewable resource revenue which is forecast at $2.9 billion – up $1.6 billion from 2021-22.

The province said that increase is mainly due to higher potash and oil price forecasts as a result of current global demand.

"While volatile world events have made commodity prices difficult to forecast, as always our revenue forecasts are based on cautious oil price projections," Harpauer said.

"It's too soon to tell if oil prices will remain high for an extended period and what impact that could have on revenues. We will continue to monitor the impact on both revenues and affordability and respond as required."

Since 2018-19, the province’s revenue has ranged between $13.6 billion and $14.8 billion.

Expense is forecast at $17.6 billion, up 3.1 per cent, or $531 million from last year’s budget.

The highest increases were seen in agriculture, education and health.

Speaking Wednesday, Minister Harpauer said the government is hoping the continued spending trend seen in the 2022-23 budget will help invigorate the province’s economy.

“Rather than doing cuts now let’s invest the money in places where people want it and will expect it and let’s get this province growing and that deficit will narrow as we go forward when we get some economic activity accelerating within our province,” she said.

The province is forecasting it spent around $2.6 billion more than budgeted in 2021-22 – largely due to agriculture supports.

The province’s current expense forecast for last year sits at $19.6 billion.

The government expects the budget to be balanced by 2026-27. Deficits of $384 million, $321 million and $165 million are projected over the next three years.

HEALTH SPENDING

Saskatchewan’s health spending remains high in 2022-23 as the province aims to recover from the effects of the COVID-19 pandemic.

The government plans to spend a record $6.8 billion on health care, including a $21.6 million increase slated to help address the surgical backlog created by the pandemic. It will fund thousands of additional surgeries in 2022 as part of a three-year plan targeting a return to pre-COVID-19 surgical wait times by March 2025.

The health budget also includes $470 million committed to mental health and addictions programs and services.

A new independent agency is also being established to recruit and retain health care workers in the province.

TAXES EXPANDING

Provincial Sales Tax (PST) will be applied to more purchases starting on Oct. 1, 2022.

The PST will apply to admission and entertainment charges for sporting events, concerts, museums, fairs, gym memberships and green fees.

Harpauer noted the additional revenue expected to be generated by the expansion of the PST will nearly cover the additional $21.6 million committed to help reduce the surgical backlog.

“If I said to a Saskatchewan resident 'would you be willing to pay this for maybe the two concerts and the Riders ticket, in order for us to address the very critical surgical waitlist,'” Harpauer said. “I think Saskatchewan people will support that.”

Exemptions will be in place for some events including school, university or minor league sports and amateur productions with unpaid participants.

The province expects to collect $10.5 million in revenue in 2022-23 and an additional $21.0 million annually.

The tobacco tax is increasing by two cents per cigarette – up to 29 cents from 27 cents. Taxes on loose tobacco will rise by eight cents per gram.

'A NO-HELP BUDGET': NDP

With costs continuing to rise around the province and across Canada, the opposition is concerned about affordability for residents.

“Not only does this budget not offer any relief for families just trying to make ends meet, it increases taxes and fees when people are already struggling to make ends meet,” NDP Leader Ryan Meili said in a news release.

“These are very serious times, with increased uncertainty caused by world events. Saskatchewan people deserve solutions to serious problems. Budget 2022 fails to offer any vision to grow our province.”

NDP Finance Critic Trent Wotherspoon called the rising costs at the pump and on store shelves a “time of serious hardship” for Saskatchewan people.

“In face of these extraordinary challenges that people face, and the windfall revenues that the province is receiving, this is a no-help budget,” Wotherspoon said. “Not a stitch of relief for working families that are doing all they can to keep their heads above water to pay the bills.”

Wotherspoon criticized the government for implementing more taxes in the budget, including the expansion of the PST.

“Taxes on Rider games and concerts and rodeos and Agribition, on the things that will allow us to come together after a time that we’ve had to be apart. It doesn’t make any sense at all,” he said.

The NDP also renewed calls for a temporary “stay” on the province’s 15 cent per litre fuel tax, or a possible rebate program.

“A glaring example of something that’s missing in this budget is the needed action to relieve the cost of fuel,” Wotherspoon said.

EDUCATION

A total of $3.8 billion budgeted for education spending in 2022-23 will help the province hire 200 full-time educational assistants for the coming school year and create more than 6,000 new child care spaces.

The operating budget for Saskatchewan school boards saw a $29.4 million increase – up to $1.99 billion – to help fund a two per cent salary increase for teachers, and provide an additional $6 million in learning supports for students.

Funding for child care and early learning is budgeted at $309.6 million, including $4.3 million to create 6,100 child care spaces in centres and care homes.

Those spaces contribute to the province’s goal of creating 28,000 new licensed spaces over the next five years.

Additionally, the funding will support further reductions in child care fees for parents, which the province said could come as early as September 2022. In February, the fees were reduced for parents by up to 50 per cent.

THE ECONOMY

Saskatchewan’s real GDP is expected to grow by 3.7 per cent this year – a slight increase of 0.2 per cent relative to the expected 3.5 per cent growth in 2021. The province said this marks a “significant” recovery from the 4.9 per cent contraction of the GDP in 2020, created by the COVID-19 pandemic.

Oil prices are expected to remain strong through 2022 and the province expects $3 billion in total investment from the industry in 2022 – a 17.5 per cent increase.

The province’s total public debt is forecast to be $30 billion on March 31, 2023 – up $2.3 billion from the forecast in last year’s budget. The government said most of its new borrowing is related to capital investment to build hospitals, schools, highways, municipal and crown infrastructure; and operations.

Saskatchewan had the lowest provincial inflation rate, 2.6 per cent, in Canada in 2021, according to the government. The national rate was 3.4 per cent.

“While inflation remains a concern, improvement related to supply chain issues and Bank of Canada interest rate increases are expected to have a cooling effect and lead to more normal price levels near the end of 2022,” the budget reads.

CAPITAL PROJECTS

The province has committed $3.2 billion to capital infrastructure projects in 2022-23, including improvements for hospitals, schools and highways.

That total includes $156.6 million dedicated to health care projects. Of that total, $53.9 million is slated to support ongoing projects including the redevelopment of the Prince Albert Victoria Hospital, the replacement of the Weyburn General Hospital, new urgent care centres in Regina and Saskatoon; and long-term care centres throughout the province.

Another $168.6 million is committed to education projects, including 95.2 million to support the building of 15 previously announced new schools and renovate five existing schools.

Additionally, $479.5 million is slated to improve more than 1,100 kilometres of highways this year and $288.6 million will be transferred to municipalities to support infrastructure projects.

CTVNews.ca Top Stories

DEVELOPING Man sets self on fire outside New York court where Trump trial underway

A man set himself on fire on Friday outside the New York courthouse where Donald Trump's historic hush-money trial was taking place as jury selection wrapped up, but officials said he did not appear to have been targeting Trump.

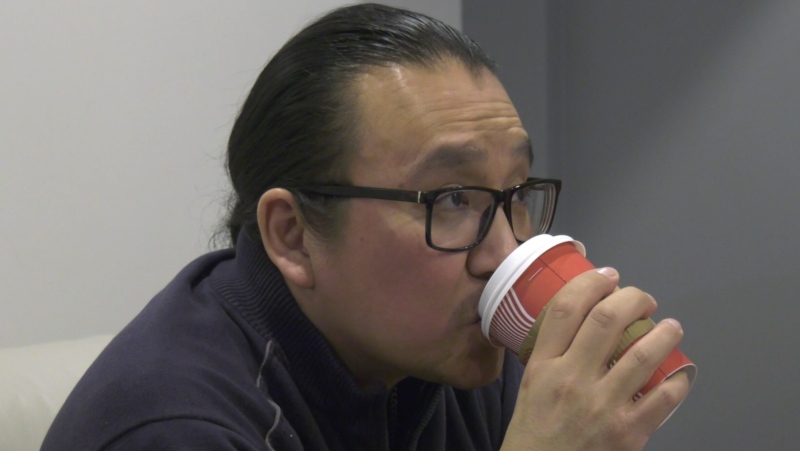

Sask. father found guilty of withholding daughter to prevent her from getting COVID-19 vaccine

Michael Gordon Jackson, a Saskatchewan man accused of abducting his daughter to prevent her from getting a COVID-19 vaccine, has been found guilty for contravention of a custody order.

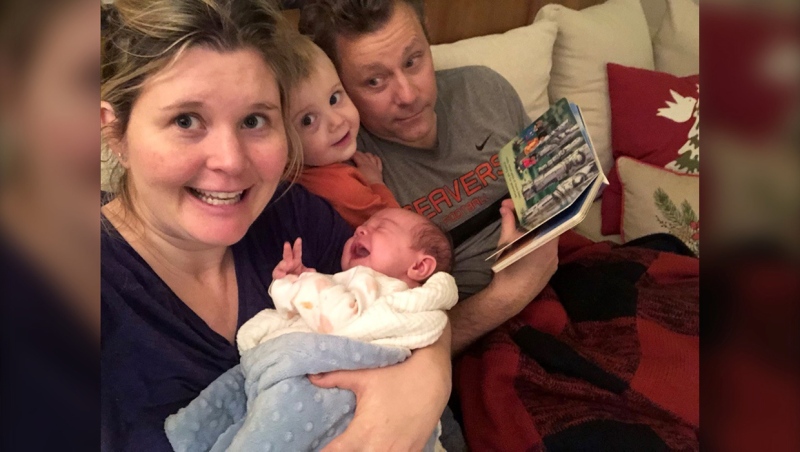

She set out to find a husband in a year. Then she matched with a guy on a dating app on the other side of the world

Scottish comedian Samantha Hannah was working on a comedy show about finding a husband when Toby Hunter came into her life. What happened next surprised them both.

Mandisa, Grammy award-winning 'American Idol' alum, dead at 47

Soulful gospel artist Mandisa, a Grammy-winning singer who got her start as a contestant on 'American Idol' in 2006, has died, according to a statement on her verified social media. She was 47.

'It could be catastrophic': Woman says natural supplement contained hidden painkiller drug

A Manitoba woman thought she found a miracle natural supplement, but said a hidden ingredient wreaked havoc on her health.

Young people 'tortured' if stolen vehicle operations fail, Montreal police tell MPs

One day after a Montreal police officer fired gunshots at a suspect in a stolen vehicle, senior officers were telling parliamentarians that organized crime groups are recruiting people as young as 15 in the city to steal cars so that they can be shipped overseas.

The Body Shop Canada explores sale as demand outpaces inventory: court filing

The Body Shop Canada is exploring a sale as it struggles to get its hands on enough inventory to keep up with "robust" sales after announcing it would file for creditor protection and close 33 stores.

Vicious attack on a dog ends with charges for northern Ont. suspect

Police in Sault Ste. Marie charged a 22-year-old man with animal cruelty following an attack on a dog Thursday morning.

On federal budget, Macklem says 'fiscal track has not changed significantly'

Bank of Canada governor Tiff Macklem says Canada's fiscal position has 'not changed significantly' following the release of the federal government's budget.