Sask. likely taking cautious approach with budget surplus, economics professor says

Saskatchewan is likely taking a cautious approach when it comes to the surplus announced in the 2023-24 provincial budget, according to an associate professor of economics at the University of Regina.

When Finance Minister Donna Harpauer revealed the budget on Wednesday, one of the province’s highlights was a projected surplus of $1 billion.

Jason Childs said with spending lower than last year and not much being done to immediately address ongoing affordability issues in Saskatchewan, it’s likely the government realizes much of that surplus came from a place of volatility.

“My hope is that it’s out of an abundance of caution and understanding that these revenues are highly volatile,” Childs said.

Much of the province’s current windfall is coming from non-renewable resource revenues.

In 2023-24, the province projects that potash will bring in about $1.3 billion and oil and gas around $963 million, two commodities that are highly influenced by global events, such as the conflict in Ukraine.

“Oil in particular is going to be subject to geopolitical events, so if somehow we saw a resolution to the conflict in Ukraine and Russia is allowed to re-enter the global oil export market, that can drastically change the price of oil,” Childs said.

He also said a very similar scenario could play out with potash.

“So when revenues are this unstable, building them [too much] into program spending is a really good way to borrow trouble that you don’t need.”

Childs said simply put, current and projected non-renewable resource revenue is something that could be flipped as quickly as a light switch.

“We saw something like that happen in 2014, with Saudi Arabia deciding they were going to discipline OPEC members and really try and assert their control over global oil markets by radically increasing production,” Childs said.

According to Childs, in every scenario it’s always a bad idea to build resource revenue into large amounts of program spending.

“I can’t stress that enough,” he said. “I would much rather see Saskatchewan do what Norway has done which is bank it all. Now they’re in an amazing situation in which they have this incredible sovereign wealth fund that completely insulates them from any of these fluctuations effectively.”

Childs said Saskatchewan is not in that position yet and has to spend some non-renewable resource revenue on program spending

However, he agreed the province was forced to be cautious with its spending this fiscal year.

“Yeah, and it’s really encouraging to hear the government making statements that say this revenue is likely to be transitory so we can’t build it all into program spending. That is being fiscally responsible, which is really encouraging to hear,” he said.

Childs said he was also really pleased to see the debt go down.

“So the budget for 2023 had the debt at $32.6 billion and we’re now at $30.8, that’s really encouraging. We’re seeing that debt number going in a really positive direction.”

Childs also said in the current economic environment, it is also a positive sign to see taxpayer-supported debt drop by nearly $3 billion.

“That’s a really good investment for the future because all that debt is going to roll over eventually at that higher interest rate, so our debt service costs are going to go way up if we don’t pay it down now,” he said.

CTVNews.ca Top Stories

'One of the single most terrifying things ever': Ontario couple among passengers on sinking tour boat in Dominican Republic

A Toronto couple are speaking out about their “extremely dangerous” experience on board a sinking tour boat in the Dominican Republic last week.

Half of Canadians have negative opinion of latest Liberal budget: poll

A new poll suggests the Liberals have not won over voters with their latest budget, though there is broad support for their plan to build millions of homes.

opinion Why you should protect your investments by naming a trusted contact person

Appointing a trusted person to help with financial obligations can give you peace of mind. In his personal finance column for CTVNews.ca, Christopher Liew outlines the key benefits of naming a confidant to take over your financial responsibilities, if the need ever arises.

Teacher shortages see some Ontario high school students awarded perfect grades on midterm exams

Students at a high school in York Region have been awarded perfect marks on their midterm exams in three subjects – not because of their academic performances however, but because they had no teacher.

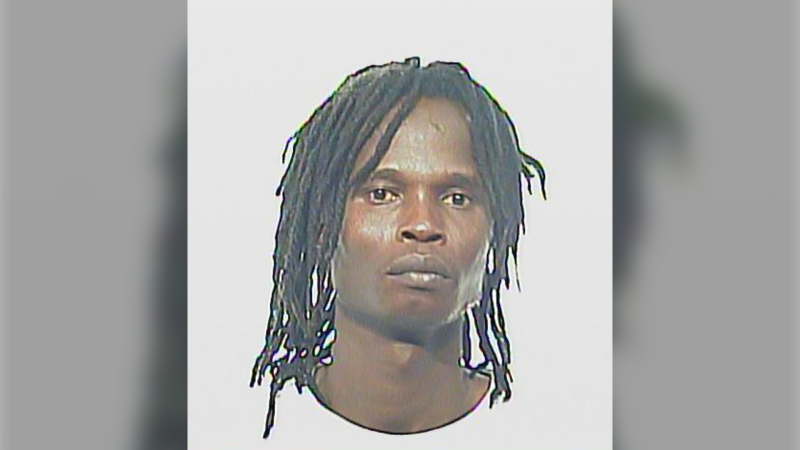

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

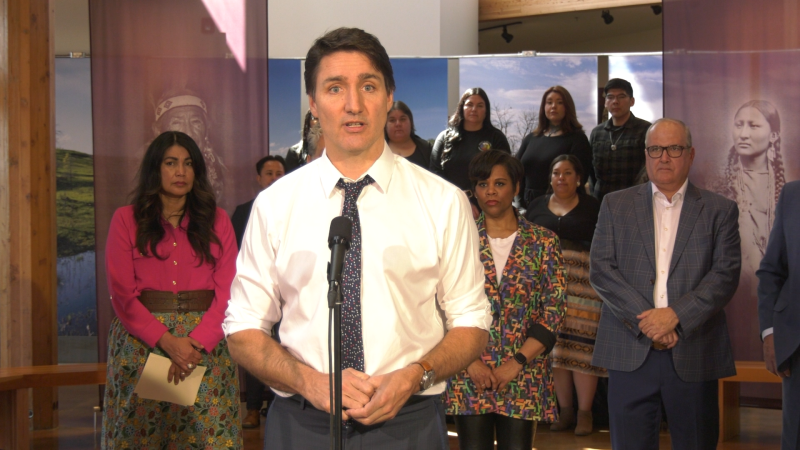

Ottawa injects another $36M into vaccine injury compensation fund

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

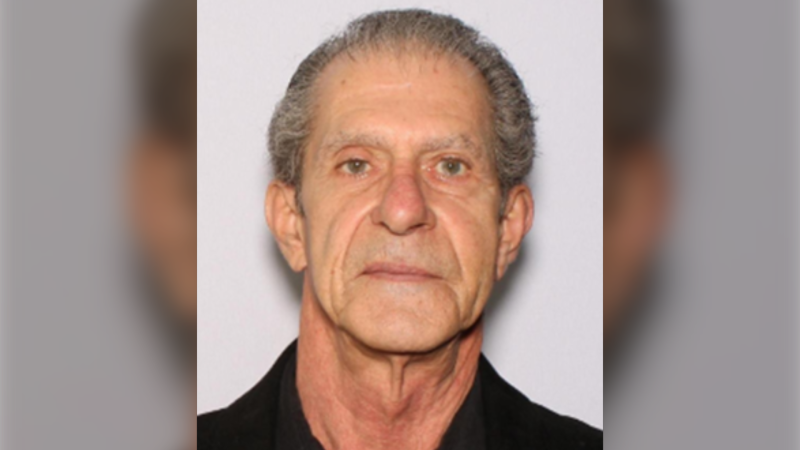

An Ontario senior thought he called Geek Squad for help with his printer. Instead, he got scammed out of $25,000

An Ontario senior’s attempt to get technical help online led him into a spoofing scam where he lost $25,000. Now, he’s sharing his story to warn others.

Her fiance has been in prison for 49 years. She's trying to free him before it’s too late

She was lying in bed on a Thursday morning, thinking about the man she loved, hoping to win his freedom before time ran out.