Volunteer first responders with 200 hours of service will be eligible for a $3,000 tax credit starting next year.

The credit comes into effect for the 2020 taxation year, the province said in a news release. Volunteer firefighters, search and rescue volunteers, and volunteer emergency medical first responders all qualify.

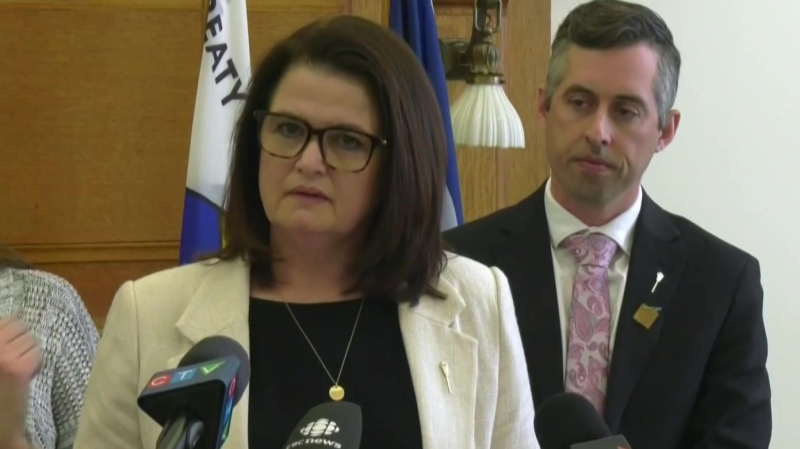

Finance Minister Donna Harpauer announced the tax credit in the 2019-2020 budget.

Saskatchewan communities, particularly in rural areas, rely heavily on volunteers to respond to emergency situations,” Harpauer said in a news release. “These volunteers put themselves at risk to protect the safety and well-being of people across Saskatchewan, and to respond to mass tragedies.”

Eligible volunteer services include working for search and rescue, emergency calls, attending required meetings and participating in required training.

The province says people with at least 200 hours of combined volunteer firefighting, search and rescue and emergency medical first responder services will be able to claim one of three credits.

Anyone who receives an honorarium for their duties can claim either an income exemption or one of the tax credits, but not both. Anyone who is paid will not qualify for the credit.

The Canada Revenue Agency will administer the tax credits, the province says.