USask study highlights more concerns with proposed Bunge-Viterra merger

Several western Canadian organizations representing producers have joined the fray in expressing their concerns over the proposed merger of Regina-based Viterra with the Swiss-founded company Bunge.

Sask. Wheat, Sask. Barley and Alberta Grains released a joint statement Monday saying the merger between the two global agricultural giants could give one company too much control of the market, passing higher costs down to smaller producers.

The trio of organizations highlighted a study conducted by University of Saskatchewan researchers Dr. Richard Gray, Dr. James Nolan and Dr. Peter Slade.

The study examined the impact of the merger at the Port of Vancouver, the canola crushing sector and competition at primary elevators and “found worrisome levels of market concentration in all three scenarios.”

According to the study, 40 per cent of the export capacity at the Port of Vancouver would be controlled by one firm.

“In this market, the proposed merger will generate an estimated $570 million in annual costs to Canadian grain producers, who will bear the brunt of the increased monopsony power,” the study read.

The concentration of market shares in the canola crushing sector would see margins increase by 10 per cent.

“The increase in export basis and canola crush margins would reduce producer income by approximately $770 million per year,” the study outlined.

Additionally, the study identified that the merger may also reduce incentives for Viterra to build its proposed canola crushing facility in Regina from $143 million per year to $78 million.

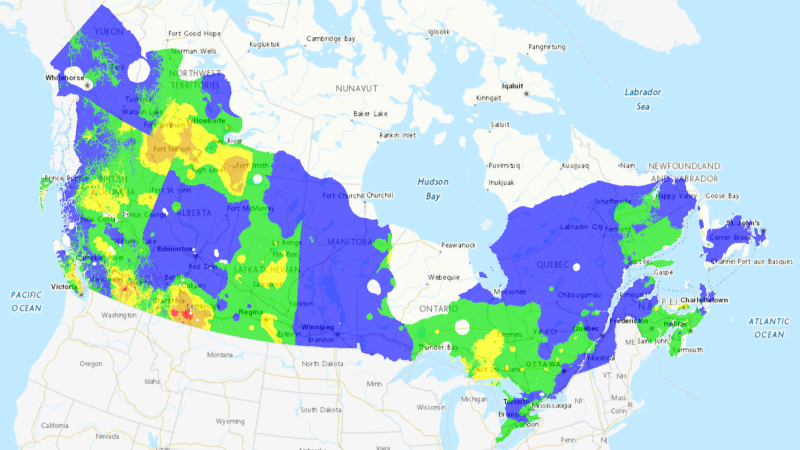

The analysis of primary elevator competition revealed concerns over market power in many areas in Western Canada, which will only get worse if the industry continues to consolidate.

“We find the [Bunge-Viterra] merger will have significant negative consequences for the Western Canadian grain export sector,” the study continued.

The study follows the release of a report by the Canadian Competition Bureau, which identified substantial anti-competitive effects and a significant loss of rivalry in select markets across the country related to the deal.

Bunge’s 25 per cent ownership stake in Viterra competitor G3 was highlighted.

The bureau identified Nipawin, Sask. and Altona, Man. as two areas of concern, where the combined market share of the two companies exceeds 45 per cent and 60 per cent.

The bureau also forecasted anti-competitive effects for the sale of canola oil in eastern Canada to customers who cannot receive oil by rail.

The Agricultural Producers Association of Saskatchewan (APAS) released its own statement following the Competition Bureau report — believing the merger would lead to more one-sided, take-it-or-leave-it grain contracts, fewer delivery options and lower prices as grain companies are able to hold more of the cards with less competition.

Bunge and Viterra have dismissed producer and industry concerns over the proposed merger, calling them “misplaced.”

Bunge Ltd. is a global agribusiness and food company headquartered in St. Louis, Missouri. Originally incorporated in Switzerland, the company boasts 23,000 employees across 300 facilities in 40 countries.

Viterra is an international agribusiness that was formed in 2007 when the Saskatchewan Wheat Pool merged with Agricore United. Headquartered in Regina, the company of 16,000 workers handles and markets grain, along with other agricultural products across 37 countries.

CTVNews.ca Top Stories

DEVELOPING Latest updates on the major wildfires burning in Canada

The 2024 wildfire season has begun, and it's shaping up to follow last year's unprecedented destruction in kind, with thousands of square kilometres already consumed.

Veteran TSN sportscaster Darren Dutchyshen has died

Veteran TSN broadcaster Darren 'Dutch' Dutchyshen, one of Canada’s best-known sports journalists, has died. He was 57. His family says 'he passed as he was surrounded by his closest loved ones.'

Toronto man killed his mother and decapitated her — but it wasn't murder, lawyers argue

A ‘lifetime of abuse’ led Dallas Ly to snap and repeatedly stab his mother inside their Leslieville apartment in 2022 but he never intended to kill her, his defence lawyers argued during at his murder trial in Toronto on Thursday.

He had dreams of running for Canada in the Olympics, then he learned his family would be deported

A burgeoning track star says his dream of going to the Olympics is being derailed by a deportation order after Immigration officials rejected his family’s claim for asylum

Father charged with second-degree murder in daughter's stabbing death southwest of Montreal

A father has been charged with second-degree murder in the stabbing death of his 34-year-old daughter in southern Quebec.

Teen died from eating a spicy chip as part of social media challenge, autopsy report concludes

A medical examiner says a Massachusetts teen who participated in a spicy tortilla chip challenge died from ingesting a substance 'with a high capsaicin concentration.'

Kidnapped by her father and kept in a crawl space: Court documents reveal Montreal horror story

A Montreal father who kidnapped his daughter who has autism and lied to police when they asked where she was should serve three years in prison, a Crown prosecutor said.

Ontario calls on Toronto to drop 'disastrous' drug decriminalization request

The province’s health minister and solicitor general are urging Toronto to rescind its request to decriminalize simple possession of small amounts of drugs for personal use, calling the proposal 'misguided' and 'disastrous.'

Trudeau calls New Brunswick's Conservative government a 'disgrace' on women's rights

Prime Minister Justin Trudeau assailed New Brunswick's premier and other conservative leaders on Thursday, calling out the provincial government's position on abortion, LGBTQ youth and climate change.