Insolvency rates in Saskatchewan are on the rise as more and more people are filing for bankruptcy or consumer proposals.

“According to the Office of the Superintendent of Bankruptcy, they report that stats across Canada, right now we're sitting right around that 300 per month new filings within Saskatchewan,” said Pamela Meger, a senior manager insolvency department with MNP.

In 2016, 3,077 people filed for a bankruptcy or a consumer proposal. A consumer proposal is where a debt settlement is negotiated between the consumer and the creditor.

The amount of people who filed in 2016 is much higher than previous years. In 2015, 2,317 filed for insolvency, around a 50 per cent increase over 2014.

MNP said one reason for the increase in insolvency rates is from the slowdown in the oil sector.

"Hotel staffs have been minimized, the restaurant staff has been minimized, the shopping the malls, employment insurance has also ran out,” said Meger. “People have been running out of income to cover off their debt and have in fact increased their debt assuming that the slowdown would be less of an impact on their credit or they would be back to work sooner than they have been,”

MNP assists people going through bankruptcy or consumer proposals. The company offers various ways to handle debt and counselling services for how to stay out of debt.

"It's a hard meeting to come to; it's a hard phone call to make. But, I can't tell you how much better people will feel once they talk to somebody and know what they options are realistically," said Meger.

MNP said people can avoid debt by creating a realistic budget and knowing where your money is going. The company added that it’s best to only spend your money in cash or debit card form.

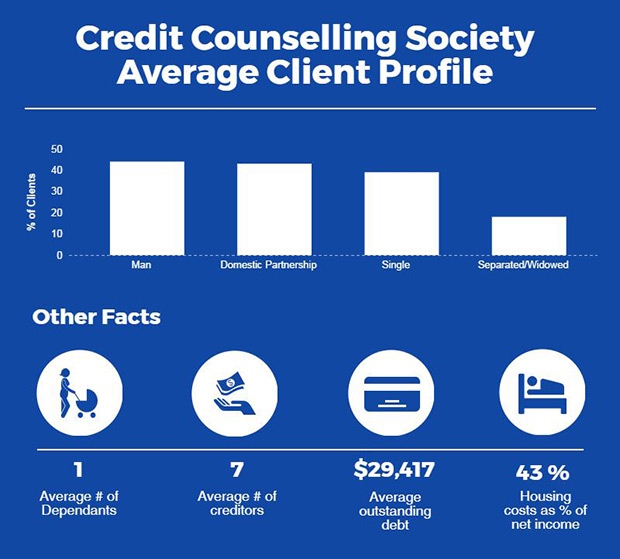

The Credit Counselling Society helps people who are financially struggling, but not at the point where they need to file for bankruptcy or a consumer proposal.

"Should I pay my credit card or should I buy groceries, should I buy my medication of should I make this load payment, those aren't decisions that people should not be making,” said Tanis Ell, a credit counsellor with the Society.

The Credit Counselling Society said all types of people financially struggle but in 2015 their average client had an unsecured debt of around $30,000.

"Spending more than they earn, living beyond their means and that's really common especially in our world right now,” Ell said. “It's very consumer driven.”