Is a massive wave of mortgage defaults coming to Sask.? One Regina broker says no

With the Bank of Canada (BoC) increasing its key rate once again this week to 4.75 per cent, many people with fixed-rate mortgages are feeling anxious about renewing.

Canada’s key interest rate is now the highest it’s been since April 2001.

Skott Enns, a mortgage broker with TMG The Mortgage Group in Regina said the latest increase, which was the first one since January, came as a surprise to many experts.

“Yeah, I think this one did take people by surprise,” Enns said. “Inflation numbers in April had increased marginally and evidentially that was all it took for the Bank of Canada to decide it was time for another increase.”

In April, inflation rose for the first time in 10 months to 4.4 per cent.

Despite the latest increase, Enns said he doesn’t believe Saskatchewan will see a plethora of mortgage defaults in the coming months.

“If you bought a home in 2018 Regina’s average house price was $325,000 and a ballpark rate back then would have been 3.54 per cent with a five per cent down payment, which meant you’d have a monthly payment of $1,629. Fast forward to today and if your mortgage is coming up for renewal, your new rate is probably going to be just a hair over five per cent, which would mean a difference of $220 [more] a month.”

Enns said one thing that could help save some people, specifically those who bought a home in the past six years, is the mortgage stress test that was implemented by the federal government in 2016, a test Ens admits he disagreed with when it was first announced.

“So all of those people that were qualified at those lower rates, even though they were two and a half per cent, they were still qualifying at about five per cent [because of the stress test]. So it’s not as though they were necessarily at the upper end of their spending limit in reality,” Enns said.

Enns also said that typically speaking, most people will be making more money than they were five years ago as they progress in their careers and gain more experience in the working world.

“I understand costs everywhere are going up, but hopefully you’re also in a better position financially as well,” he said.

One year ago, the BoC’s key interest rate was 1.5 per cent.

In July 2022, an increase of a full percentage point was announced, which was followed by three smaller increases heading into 2023 leading to today’s key rate of 4.75 per cent.

The next scheduled rate announcement is expected on July 12, 2023.

Enns said with this week’s surprising increase, the crystal ball is as foggy as ever, but said many in his industry remain hopeful some rate decreases are coming.

“Within the next say 12 months, I think that is a reasonable expectation.”

Enns admitted that while the days of one and two per cent for variable and fixed rates are more than likely gone for good, a middle ground from then to where we are now is achievable.

“We got spoiled, you know, for the better part of a decade really with those rates. If we can get back to a point where, you know, fixed rates even start with a three, I think that would be wonderful.”

-- With files from CTV News.ca.

CTVNews.ca Top Stories

BREAKING Alice Munro, Nobel literature winner revered as short story master, dead at 92

Nobel laureate Alice Munro, the Canadian literary giant who became one of the world's most esteemed contemporary authors and one of history's most honoured short story writers, has died at age 92.

Latest updates on air quality alerts, and when the smoke may reach Ontario and Quebec

Wildfires have led Environment Canada to issue air quality advisories for parts of B.C., Alberta, Manitoba, Saskatchewan and the Northwest Territories, as forecasters warn the smoke could drift farther east.

Are these Canada's best restaurants? Annual top 100 list revealed

The annual list of Canada's top restaurants in the country was just released and here are the places that made the 2024 cut.

Attack on prison van in France kills 2 officers, inmate escapes

Armed assailants killed two French prison officers and seriously wounded three others in an attack on a convoy in Normandy on Tuesday and an inmate escaped, officials said.

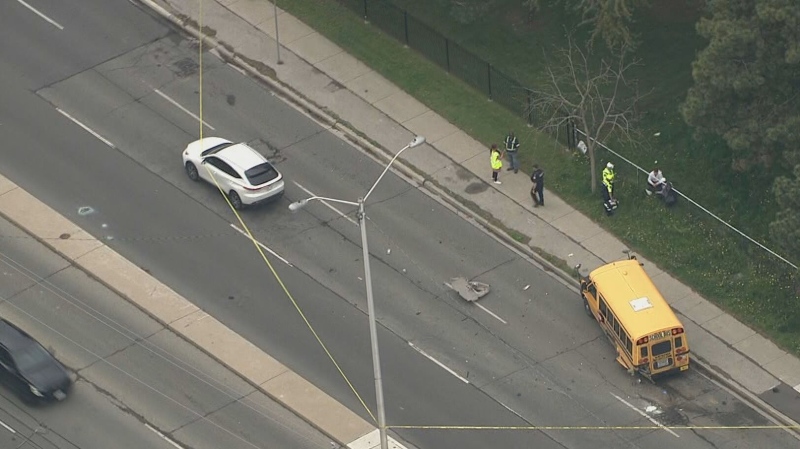

Steal a car, lose your driver's licence for 10 years under new Ontario proposal

Repeat car thieves may face lengthy licence bans under proposed changes to Ontario’s Highway Traffic Act.

$1.6B parts plant for Honda electric vehicle batteries coming to Niagara Region

A Japanese company has announced it will build an approximately $1.6-billion plant in Ontario's Niagara Region that will make a key electric vehicle battery component as part of Honda's supply chain in the province.

B.C. brings in law on name changes on day that child killer's new identity revealed

The BC NDP have tabled legislation aimed at stopping people who have committed certain heinous acts from changing their names.

Manitoba premier to visit areas impacted by wildfire

Manitoba Premier Wab Kinew will get a close-up look at the devastation from a large wildfire burning in northern Manitoba Tuesday.

1 killed, 3 injured including toddler, after Hwy. 417 crash in Ottawa

Ontario Provincial Police are responding to a fatal collision involving two vehicles on Highway 417 in Ottawa's west end on Tuesday morning.