Is a massive wave of mortgage defaults coming to Sask.? One Regina broker says no

With the Bank of Canada (BoC) increasing its key rate once again this week to 4.75 per cent, many people with fixed-rate mortgages are feeling anxious about renewing.

Canada’s key interest rate is now the highest it’s been since April 2001.

Skott Enns, a mortgage broker with TMG The Mortgage Group in Regina said the latest increase, which was the first one since January, came as a surprise to many experts.

“Yeah, I think this one did take people by surprise,” Enns said. “Inflation numbers in April had increased marginally and evidentially that was all it took for the Bank of Canada to decide it was time for another increase.”

In April, inflation rose for the first time in 10 months to 4.4 per cent.

Despite the latest increase, Enns said he doesn’t believe Saskatchewan will see a plethora of mortgage defaults in the coming months.

“If you bought a home in 2018 Regina’s average house price was $325,000 and a ballpark rate back then would have been 3.54 per cent with a five per cent down payment, which meant you’d have a monthly payment of $1,629. Fast forward to today and if your mortgage is coming up for renewal, your new rate is probably going to be just a hair over five per cent, which would mean a difference of $220 [more] a month.”

Enns said one thing that could help save some people, specifically those who bought a home in the past six years, is the mortgage stress test that was implemented by the federal government in 2016, a test Ens admits he disagreed with when it was first announced.

“So all of those people that were qualified at those lower rates, even though they were two and a half per cent, they were still qualifying at about five per cent [because of the stress test]. So it’s not as though they were necessarily at the upper end of their spending limit in reality,” Enns said.

Enns also said that typically speaking, most people will be making more money than they were five years ago as they progress in their careers and gain more experience in the working world.

“I understand costs everywhere are going up, but hopefully you’re also in a better position financially as well,” he said.

One year ago, the BoC’s key interest rate was 1.5 per cent.

In July 2022, an increase of a full percentage point was announced, which was followed by three smaller increases heading into 2023 leading to today’s key rate of 4.75 per cent.

The next scheduled rate announcement is expected on July 12, 2023.

Enns said with this week’s surprising increase, the crystal ball is as foggy as ever, but said many in his industry remain hopeful some rate decreases are coming.

“Within the next say 12 months, I think that is a reasonable expectation.”

Enns admitted that while the days of one and two per cent for variable and fixed rates are more than likely gone for good, a middle ground from then to where we are now is achievable.

“We got spoiled, you know, for the better part of a decade really with those rates. If we can get back to a point where, you know, fixed rates even start with a three, I think that would be wonderful.”

-- With files from CTV News.ca.

CTVNews.ca Top Stories

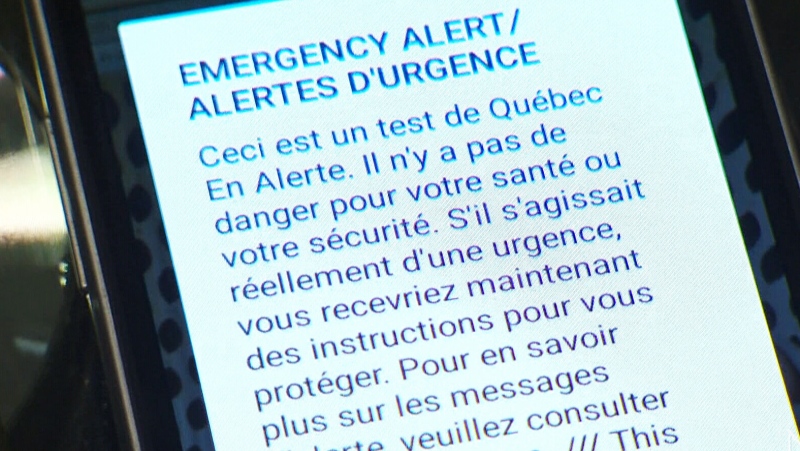

Most of Canada to receive emergency alert test today

The federal government will test its capacity to issue emergency alerts today, with the exception of Ontario, where the test will take place on May 15.

OPINION What King Charles' schedule being too 'full' to accommodate son suggests about relationship with Prince Harry

Prince Harry, the Duke of Sussex, has made headlines with his recent arrival in the U.K., this time to celebrate all things Invictus. But upon the prince landing in the U.K., we have already had confirmation that King Charles III won't have time to see his youngest son during his brief visit.

Ontario man devastated to learn $150,000 line of credit isn't insured after wife dies

An Ontario man found out that a line of credit he thought was insured actually isn't after his wife of 50 years died.

Boy Scouts of America is rebranding. Here's why they're now named Scouting America

After more than a century, Boy Scouts of America is rebranding as Scouting America, another major shakeup for an organization that once proudly resisted change.

New Canadian study could be a lifesaver for thousands suffering from CTE

A first-of-its-kind Canadian research study is working towards a major medical breakthrough for a brain disorder, believed to be caused by repeated head injuries, that can only be detected after death.

Rape, terror and death at sea: How a boat carrying Rohingya children, women and men capsized

In March, Indonesian officials and local fishermen rescued 75 people from the overturned hull of a boat off the coast of Indonesia. Until now, little was known about why the boat capsized.

Stormy Daniels describes meeting Trump during occasionally graphic testimony in hush money trial

With Donald Trump sitting just feet away, Stormy Daniels testified Tuesday at the former president's hush money trial about a sexual encounter the porn actor says they had in 2006 that resulted in her being paid to keep silent during the presidential race 10 years later.

These adults born in the '90s partnered with their parents to buy homes in Ontario

An Ontario woman said it would have been impossible to buy a house without her mother – an anecdote that animates the fact that over 17 per cent of Canadian homeowners born in the ‘90s own their property with their parents, according to a new report.

For their protection, immigrants critical of China and India call for speedy passage of Canada's foreign interference legislation

Canadian immigrants threatened by hostile regimes are urging parliamentarians to quickly pass the 'Countering Foreign Interference Act' so they can feel safe living in their adopted home.